Just recently Ikejabird reported that in just three months in 2023, bank customers have lost N472 million naira to scams.

It was also reported that from January to March, 12,552 fraud cases were reported, recorded, and are currently under review.

Also, statistics showed that mobile fraud comprised 34.07% at N161 million, then computer/web fraud accounted for 27.69% at N130 million, and lastly, fraudulent withdrawals represented 24.72% at N116 million.

READ ALSO: Ikeja residents recount experience with pick pockets and scammers in computer village

All these have proven that anyone can be a victim of fraudsters who have aimed, planned, and set their games before approachings their victims.

However, we will be looking at some of those things that one should beware of in order to not fall victim to scams.

Buying or selling

This type of scam is pretty common and mostly for people who buy things online. Apparently, some of these online vendors are not truly who they claim to be i.e, they do not sell what they claim to have and scam people by collecting money from them and not sending their goods.

Fake calls

Another type of scam that these fraudsters make use of is fake calls or alerts. Have you suddenly gotten a call from someone who tells you that they are one of the bankers working in your banks?

They draw you in by revealing your name or some basic information about you, well if you haven’t, it happens, an instruction that bank authorities give is they will never tell you to send an OTP or something private about you except maybe your account number.

However, some people have fallen victim to revealing their card numbers and OTP (One Time Password) to people who claimed to be bankers. Never ever reveal your details to anyone who suddenly gives you a call and asks for your details.

READ ALSO: Bank customers who fell victim to fraudsters in 3 months lose N472m

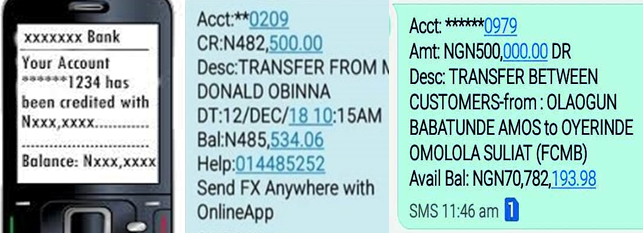

Fake Alerts

Just recently a Nigerian man who seek anonymity shared his story of how he was scammed after he received a fake alert.

Apparently, he sold his phone and got a message on his phone from his bank that he has been credited the amount he agreed with the buyer.

However, when he got home, he got the shock of his life when he checked his Bank app and didn’t see the transaction. Beware of fake alerts, if you are a business person and someone sent you money, a tech guy shared with Ikejabird, that it is advisable for you to transfer a part of that money to another account, this proves that the money has truly been received.

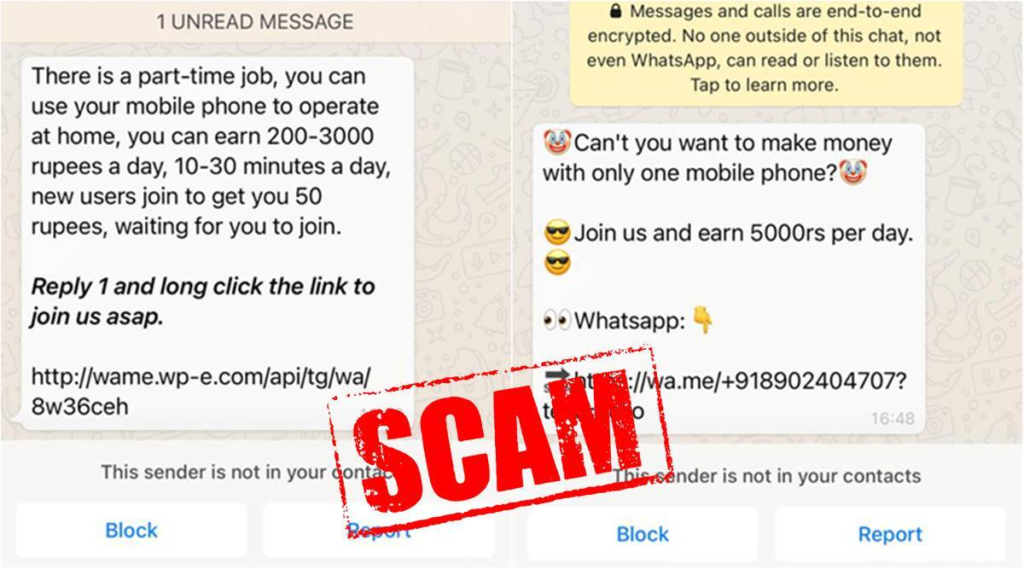

Fake Jobs

If you are a Nigerian looking for a job, you most definitely would have gotten a message that offers you a job that is too good to be true, beware of this.

Attached to the messages are links that when you click on might reveal your privacy, if you do not apply for a job from the said company, do not click on it.

Moreover, a company hardly reaches out to you via messages they do that by mail and would a company tell you to click on a link? hence when you see this, it should be a red flag.

READ ALSO: Scammer Who Bolted with Usain Bolt $12 Million Gets Ultimatum

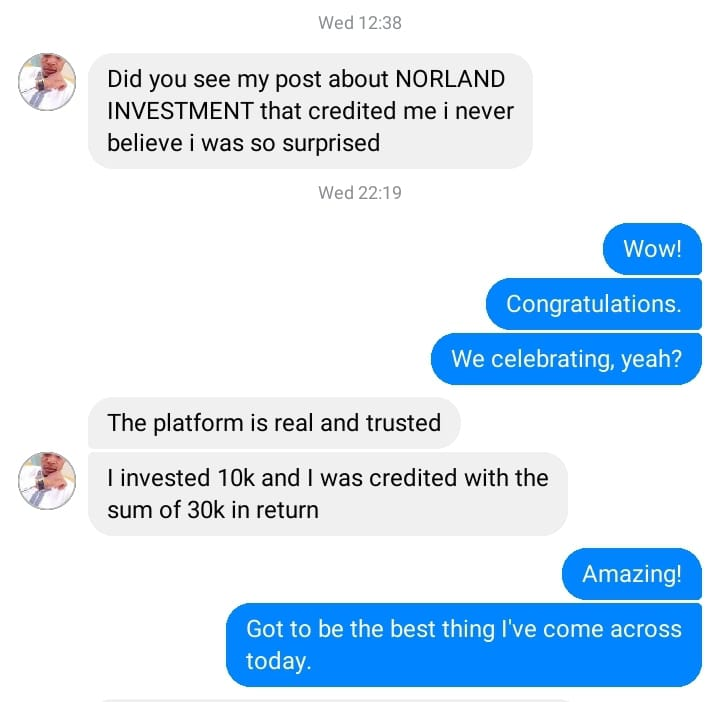

Investment Scams

‘Invest one, get 3’, be skeptical and wise, investment scams are messages you get that promises that you will get a high return if you invest in something which is not true.

Hijacking social media accounts

This is common, but many still fall victim, if someone sends you a message promoting an investment whereby they tell you that they’ve done it and won a certain amount, do not fall victim to it, call the said person to confirm if it truly was him/her.

There are many other fraudulent actions that these scammers use, however, one thing all have in common is a person needs to be careful, be conscious of who they are sending their details to, and most importantly if possible do not share your details with anybody.