By Ayodimeji Falade

In recent years, thousands of Nigerians have fallen prey to the devious antics of money-doubling platforms, popularly known as Ponzi schemes. IkejaBird looks at the trend and how Nigerians are yet to learn from the painful history of Ponzi-Schemes.

1. Mavrodi Mundial Moneybox (MMM) (2015)

One of the most popular money doubling schemes in Nigeria history. This scheme entered Nigeria economy claiming an overall 30% of market capital.

MMM was launched in 2011 globally and crashed in December 2016. It was founded by Russian ex-convict Mavrodi Sergei, he used this system to successfully defraud people globally, and died March 26, 2018.

The scheme started in Nigeria in 2015 promising 30% investment return on their capital. Millions were rolling in and out until the platform had higher logs of people who wanted to withdraw than those ready to invest.

It is estimated that this scam took about 30 million people into bankruptcy in Russia and Nigeria. The pyramid scheme may have taken 10 billion from Nigerians, causing many suicides and bankruptcies.

2. 86FB/86Z (2022)

Early this year, another Ponzi scheme came into Nigeria, but this was introduced in another dimension with the tactics of sport betting.

Promising Nigerians returns of 3% on each of the bets placed and a massive increase in their investments was promised.

Thousands of Nigerians swung towards this Ponzi and eventually lost millions to this Chinese Ponzi company. The users of the platform were unable to make withdrawals.

This Ponzi scheme even registered under the Corporate Affairs Commission (CAC) using fake identities.

“Nigerians and greed na 5&6 bring another Ponzi with mouth offering returns tomorrow, and you’d see them scrambling to throw in money.

That’s why politicians use the masses to play ping-pong” Max (M) describes how Nigerians get swindled.

Many still fall for this cheap scams and hope to double investments.

3. Racksterli (2020)

In the fall of 2020 COVID-19 pandemic the economy suffered massive layoffs, inflation, high food prices, and Nigerians at that point were desperate to sustain their finances.

It was at this time Micheal Chidiebiere Oti popularly known as “Black diamond” took advantage of the hard time to introduce yet another Ponzi scheme which promised investors 40+% return on their investments.

He even went far as getting celebrities to endorse this platform like Davido, Nancy Isime and Williams Uchemba which was a perfect strategy to win more hearts to believe it a safe investment.

Until there were difficulties in getting returns on investments and the CEO started giving excuses and lies and went off into thin air with investors millions.

4. Binomo Investment Scams (2019-2022)

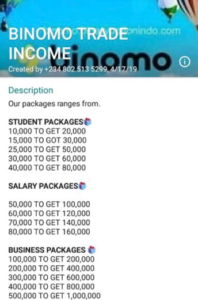

Like every other Forex trading platforms, Binomo is among the top platforms for this purpose. But there is a charade around this name as some criminal element created another clone platform of similar names.

With similar names, it will be difficult for victims to find out if they are fake. They bring offers of trading and multiplying their investments in minutes and hours.

Many Nigerian investors have been scammed millions.

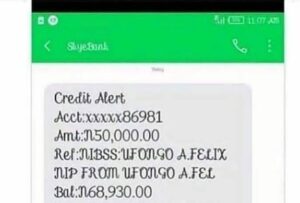

They message their clients on social media to pitch the idea, showing fake evidence of payments and any gullible victim enters this trap and lose monies simultaneously.

5. Popoyo investment (2021/2022)

Kunle Adesua’s Poyoyo Investment Scam was a popular Ponzi scheme in the south-western region and other part of Nigeria. This cover up investment scheme defrauded thousands of people in the scam.

The Ponzi scheme presented 4 different plans of investments that offer 20-30% ROI to its defrauded victims.

After operating for some months with several warnings from Securities and Exchange Commission (SEC) to people, the swindler was able to convince investors to commit more to the platform.

They carted away over 50 million Naira and more from their investors.

These and many more Ponzi schemes exist in Nigeria with millions of people putting in their hard-earned income expecting fictional returns.

Experts explained that Ponzi schemes are not difficult to detect as it comes with unbelievable returns and promises in a short period of time. But the mindset of average Nigerians for get-rich-quick initiatives will keep leading them into the hands of scammers.