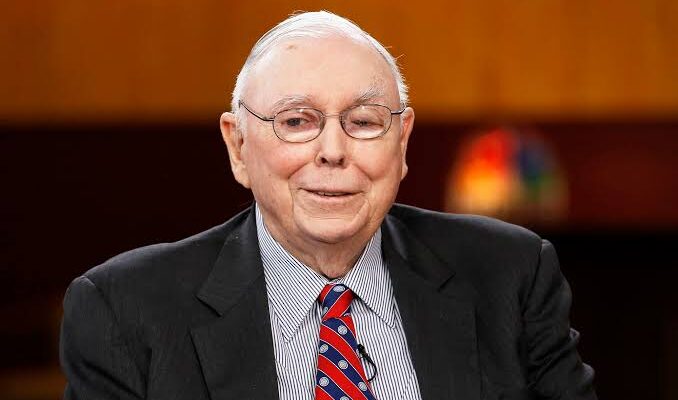

Charlie Munger, the renowned vice chairman of Berkshire Hathaway, is not merely a business magnate but a living legend in the realm of finance and investment.

His life story is a fascinating journey marked by intelligence, wit, and an unwavering commitment to the principles that have shaped his extraordinary success.

This article delves into the biography of Charles Thomas Munger, shedding light on his early life, career, investment philosophy, and the profound impact he has had on the world of business.

READ ALSO: Dr. Victor Chang: Pioneer of modern heart transplant surgery

Early years and education

Born on January 1, 1924, in Omaha, Nebraska, Charlie Munger’s childhood was shaped by the challenges of the Great Depression.

Raised in a family of modest means, Munger’s early experiences instilled in him a strong work ethic and a keen appreciation for the value of money.

Despite financial constraints, he displayed exceptional academic prowess, earning a scholarship to the University of Michigan.

Munger’s intellectual curiosity led him to study a diverse range of subjects, eventually obtaining a degree in mathematics in 1949.

Later, he attended Harvard Law School, where he further honed his analytical skills and developed a deep understanding of legal frameworks.

Munger’s multidisciplinary approach, blending mathematics and law, would later become a hallmark of his unique perspective in the world of finance.

Building a legal career

After completing law school, Charlie Munger established a successful legal practice in California.

His keen legal mind and attention to detail propelled him to success, but Munger was not content to limit himself to the legal profession.

His entrepreneurial spirit led him to explore opportunities beyond law, setting the stage for his transition into the business world.

Enterprising ventures

Munger’s foray into business began with real estate investments, marking the inception of a career characterized by a diverse range of ventures.

In the early 1960s, he teamed up with Jack Wheeler to form Wheeler, Munger, and Company, a firm engaged in real estate development.

This venture laid the groundwork for Munger’s future endeavors and revealed his acumen for identifying lucrative investment opportunities.

Partnership with Warren Buffett

The turning point in Charlie Munger’s career came when he crossed paths with Warren Buffett, a meeting that would significantly shape the trajectory of both their lives.

Munger and Buffett first connected at a dinner party in 1959, marking the beginning of a lifelong partnership.

United by their shared values, investment philosophies, and an unwavering commitment to ethical business practices, Munger and Buffett forged a bond that would transform Berkshire Hathaway into a global conglomerate.

As vice chairman of Berkshire Hathaway, Munger played a pivotal role in the company’s remarkable growth.

His complementary skill set, paired with Buffett’s investment genius, contributed to the creation of one of the most successful and respected conglomerates in the world.

Munger’s influence extended beyond investments; he became known for his insightful commentary on a wide range of topics, blending wisdom, humor, and a straightforward approach.

Investment philosophy

Charlie Munger’s investment philosophy, often referred to as the “Munger approach,” is grounded in a set of principles that have become guiding tenets for many investors.

One of the key principles is the importance of understanding multiple disciplines. Munger’s belief in developing a broad mental framework, encompassing various fields such as psychology, economics, and mathematics, has been instrumental in his success.

Another cornerstone of Munger’s philosophy is the emphasis on the concept of “lattice work of mental models.”

He advocates for building a comprehensive set of mental models from various disciplines to enhance decision-making.

This approach encourages investors to avoid a narrow viewpoint and instead consider a multitude of factors when evaluating opportunities and risks.

Influence beyond finance

While Charlie Munger is celebrated for his financial acumen, his influence extends beyond the realm of investments.

An avid reader and lifelong learner, Munger has been a proponent of continuous education and intellectual curiosity.

His speeches and writings cover a wide array of subjects, including psychology, human behavior, and ethics.

Munger’s candor and wit have made him a sought-after speaker at events such as the annual Berkshire Hathaway shareholder meetings.

His famous speeches, often referred to as “Mungerisms,” are a collection of insightful and sometimes humorous observations on life, business, and decision-making.

Munger’s ability to distill complex concepts into simple yet profound insights has endeared him to audiences worldwide.

Philanthropy and legacy

Beyond his business endeavors, Charlie Munger is actively involved in philanthropy.

He, along with his wife, Nancy, has made significant contributions to educational institutions, including the construction of the Munger Graduate Residences at Stanford University.

Their philanthropic efforts reflect Munger’s commitment to supporting education and fostering intellectual development.

As Munger continues to contribute to the success of Berkshire Hathaway and share his wisdom with the world, his legacy remains firmly rooted in the principles of integrity, intellectual curiosity, and the pursuit of excellence.

His life serves as an inspiration to aspiring entrepreneurs, investors, and anyone seeking a path to success that transcends financial achievements.

READ ALSO: Jimmy Carter: A life of service, diplomacy, and advocacy

Conclusion

Charlie Munger’s biography is a testament to the power of intellect, curiosity, and a commitment to lifelong learning.

From humble beginnings during the Great Depression to becoming a revered figure in the world of finance, Munger’s journey offers valuable lessons in resilience, adaptability, and the importance of ethical decision-making.

As he continues to shape the landscape of investments and share his insights, Charlie Munger stands as a sage of success, leaving an indelible mark on the realms of business, education, and philanthropy.