By Oluwayanmife Ayobami

John Adewale, a 45-year-old businessman, is facing the prospect of losing his family home after failing to repay a loan he took from a bank that is now liquidated.

Adewale had borrowed ₦50 million from APEX Bank in 2015 to expand his small manufacturing business. However, the business ran into difficulties, and Adewale was unable to make the loan repayments.

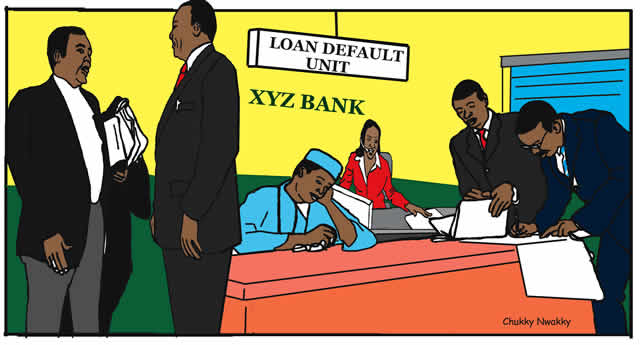

APEX Bank was one of the banks taken over by the Nigeria Deposit Insurance Corporation (NDIC) in 2017 due to insolvency issues. The Asset Management Company of Nigeria (AMCON) was then tasked with recovering loans that were non-performing for the failed bank.

When AMCON came calling for Adewale, he was unable to settle the outstanding ₦30 million balance, plus accrued interest on the loan.

He had used the title documents for his family home, which was worth ₦50 million, as security for the loan. The AMCON lawyer, Michael Smith, explained that when someone uses their property as collateral for a loan and can’t pay it back, AMCON had the right to take over the property to get the money owed. So, since Adewale had handed over the title to his home, AMCON could take steps to seize the property if he didn’t repay his debt.

Smith further explained that under the AMCON Act, the agency had wide-ranging powers to recover unpaid loans it had taken over from defunct banks.

Before enforcing its rights over the collateral, AMCON had said it had explored alternatives such as debt restructuring and repayment extensions. However, in Adewale’s case, the loan was substantial, and he had not been able to put forward a viable plan to settle the debt.

While Adewale’s lawyers plead that AMCON consider his circumstances, arguing that seizing a family home should really be an absolute last resort. In their words, AMCON should have given him more time to try and raise funds before throwing him out onto the streets?

But AMCON believes they have certain responsibilities and can’t keep extending deadlines forever. Their lawyer has explained that they aren’t heartless, but have to balance the borrower’s rights with their duty to get back public money. The law has given them a specific time to use the collateral’s value.

Implications of Using a House as Collateral

- The family risks losing the roof over their heads and becoming homeless if the loan cannot be repaid

- Secured loan means lender can foreclose your home if you default on payments.

- Interest rates are lower since lenders see it as less risky with an asset to recover costs.

- Risk losing your home if unable to repay and facing foreclosure.

- May impact eligibility for other loans till this one using house as collateral is closed.

A property developer in Ikeja lost two uncompleted housing estates worth over ₦100 billion in 2021 when he was unable to service the loans he obtained from two banks to finance the projects. The landed properties were used as collateral.

Advice to Those That want to Use Assests as a Collateral

Legal experts have pointed out that while debtors have deserved protection, taking a loan with collateral comes with responsibilities.

- Carefully assess your repayment capacity and only borrow what you are confident you can repay on time. Don’t over-borrow.

- Consider using only a portion of your property’s value as collateral rather than the entire property to reduce risk of losing your home.

- Discuss partial collateral instead of entire property to balance interest rate and risk.

- Fully understand the terms of the loan, including interest rates, repayment period, penalties for late payment etc. before signing.

- Factor in potential expenses like maintenance costs, unforeseen emergencies that could impact your repayment ability.

- Insure the property adequately against risks like fire, flooding etc. to protect the lender’s interest in the collateral.

- Maintain the property to preserve its value so the lender can recover costs if there’s need to sell it.

For Adewale, losing his home, where his family has lived for nearly 20 years, is devastating. He has pleaded for more time, confident he can find the money somehow. As the deadline for AMCON to take his property approaches, Adewale’s situation becomes a tricky balance between the rights of borrowers and the claims creditors have on collateral.