By Ayodimeji Falade

For sometime now, the Nigeria economy has been declining; leading to currency devaluations, inflation and reoccurring recessions.

Among all these downsides in the economy, the most constant of it all is how the Dollar rate has always appreciated against the Nigerian currency, “NAIRA”.

On October 29, 2022, Naira crashed to #800 to a Dollar on a black market rating, making it a successive depreciation for the first time reaching this biggest low.

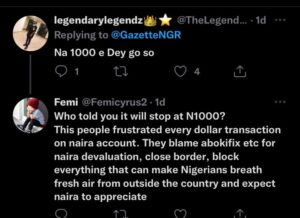

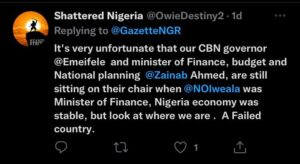

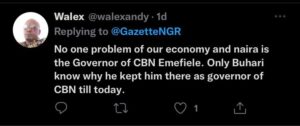

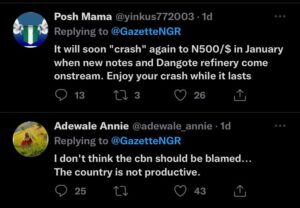

Reacting, many Nigerians took to their social media to lament the new exchange rate as some said the CBN boss Mr. Godwin Emefiele has been incompetent in his job while others blame the country’s poor production initiatives as they regarded Nigeria economy as consuming economy which led to this crash.

Many would have be puzzled about why Nigeria suffers this consistent crashes and how it affects the lives of average Nigerians.

Some economists said low Dollars in circulation caused a major part of the problem, as they regarded it as a predicated scenario that had been created because of the government’s inability to ensure there were enough dollars in circulation.

How can the country make sure dollars are in the economy?

— invest in education, so that more foreigners would come to the country and pay tuition in dollars.

— Make sure the major foreign exchange product which is oil is properly managed, and each of the dollars earned are accounted for.

— Do more of exportation than the usual importation.

Among all these, the constant devaluation caused by low supply in Dollars as against it high demand in circulation would stop.

As the tension keeps going up, there is need to find out how this high rate of dollars will affect Nigerians. However, a Twitter thread made by one Micheal Ebiekutan who is a finance expert explained the effects of the dollar prices on an average Nigerian.

“Consider the effect of the Naira’s appreciation/depreciation on the Nigerian economy.”

“If Naira falls against the dollar, the rising prices of goods and services will offset your gains. If Naira rises against it, the falling prices of goods and services will offset your loss.”

He further explained that many would see the devaluation of Naira differently, but local Nigerians would make no profit as well as loss with it.

Although many Nigerians has stopped the blame trade over the Naira devaluation as many said they believed a good economy isn’t determined by dollar rate as one used South Korea exchange rate as a focal point.

As we move ahead to 2023 elections, and the announcement made to redesign Naira, many has predicted a further depreciation of the Naira as they foretell a #1000 Naira to a dollar exchange.